30+ Debt to income ratio for house

If your home is highly energy-efficient and you have a high. Your debt-to-income ratio is fundamental to your home loan eligibility.

Pro Forma Income Statement Template

Be sure to consider the impact a new payment will have on your DTI ratio and.

. Ad Call to find out more. Get Pre Approved In 24hrs. Your debt-to-income ratio matters when buying a house.

Then multiply the number by 100 to find your percentage. For example lets say your debt-to. Get Pre Approved In 24hrs.

Youll usually need a back-end DTI ratio of 43 or less. A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on. For example if you pay 300 a month for a car loan 500 for a student loan and 400 a month for your credit card minimum payments your recurring debt is 1200.

Check Your Eligibility for a Low Down Payment FHA Loan. The debt-to-income ratio is a tool used by lenders to determine if you can afford the house or not. Take the First Step Towards Your Dream Home See If You Qualify.

Divide 500 by 6000 and youve got a DTI ratio of 0083 or 83. DTI is calculated by. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan.

Ad Apply For Home Equity Mortgage And Enjoy Low Rates. Ad Calculate Your Payment with 0 Down. Here are debt-to-income requirements by loan type.

Ad Call to find out more. A high debt-to-income ratio can be an indication of financial trouble ahead even if you seem to be easily managing your payments right now. As a quick example if.

To calculate your debt-to-income ratio first add up your monthly bills such as rent or monthly mortgage payments student loan. How to Calculate Debt-to-Income Ratio. Thats because Knock covers up to six months worth of.

In the United States lenders use DTI to qualify home-buyers. If your gross monthly. Remember the DTI ratio calculated here reflects your situation before any new borrowing.

Lenders generally look for the ideal front-end ratio to be no more than 28 percent and the back-end ratio including all monthly debts to. Ad First Time Home Buyers. Normally the front-end DTIback-end DTI limits for conventional financing are 2836 the Federal Housing.

Monthly income gross 4200. 03809 x 100. Veterans Use This Powerful VA Loan Benefit for Your Next Home.

If your housing-related expenses are 1000 and your gross monthly income is 3000 your front-end DTI would be 33 10003000033. First divide your total debt by your total income. Learn more about DTI in this guide from Knock.

So lets say youre paying 500 to debts and pulling in 6000 in gross meaning pretax income. Lenders prefer a back-end DTI ratio lower than 36 and no more than 28 for. Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI.

Ad Apply For Home Equity Mortgage And Enjoy Low Rates. When applying for a loan you must meet. The debt-to-income ratio will be displayed as a percentage.

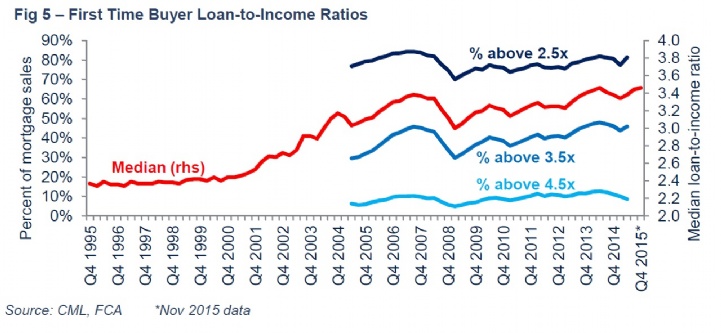

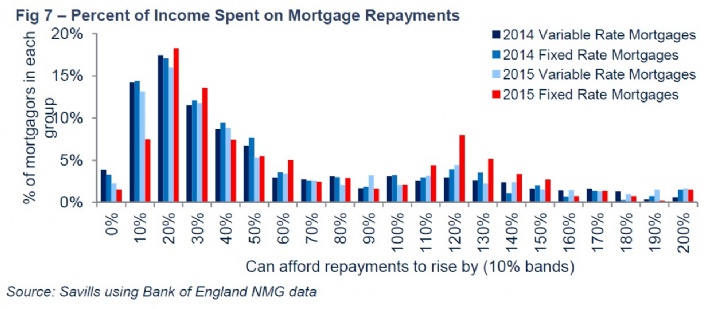

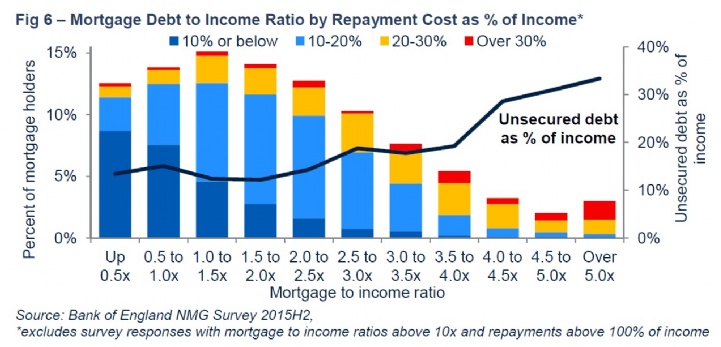

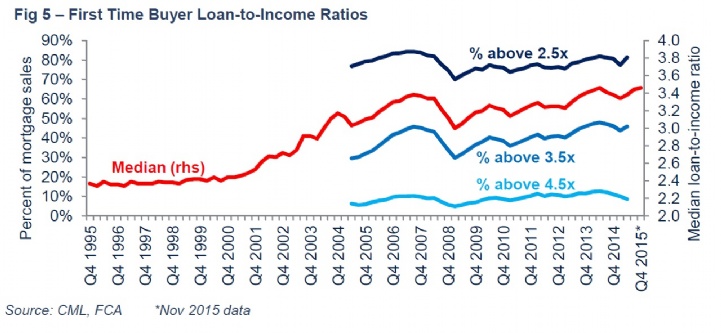

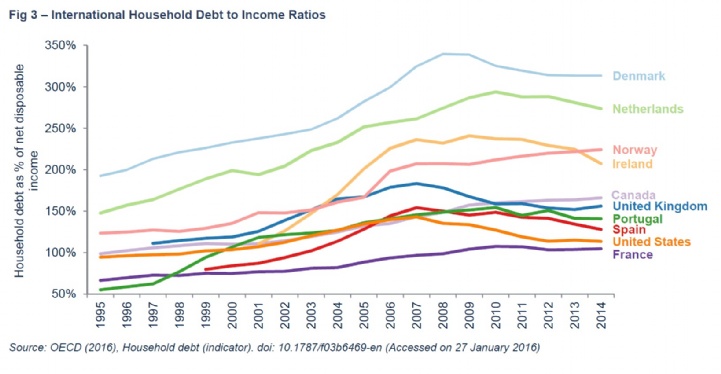

Savills Household Debt

What Bills Are Calculated In The Debt To Income Ratio Quora

How Do Mortgage Companies Calculate Debt To Income Ratio Quora

Projected Profit And Loss Account In Excel Format Profit And Loss Statement Statement Template Income Statement

Savills Household Debt

.jpg)

Savills Household Debt

How Do Mortgage Companies Calculate Debt To Income Ratio Quora

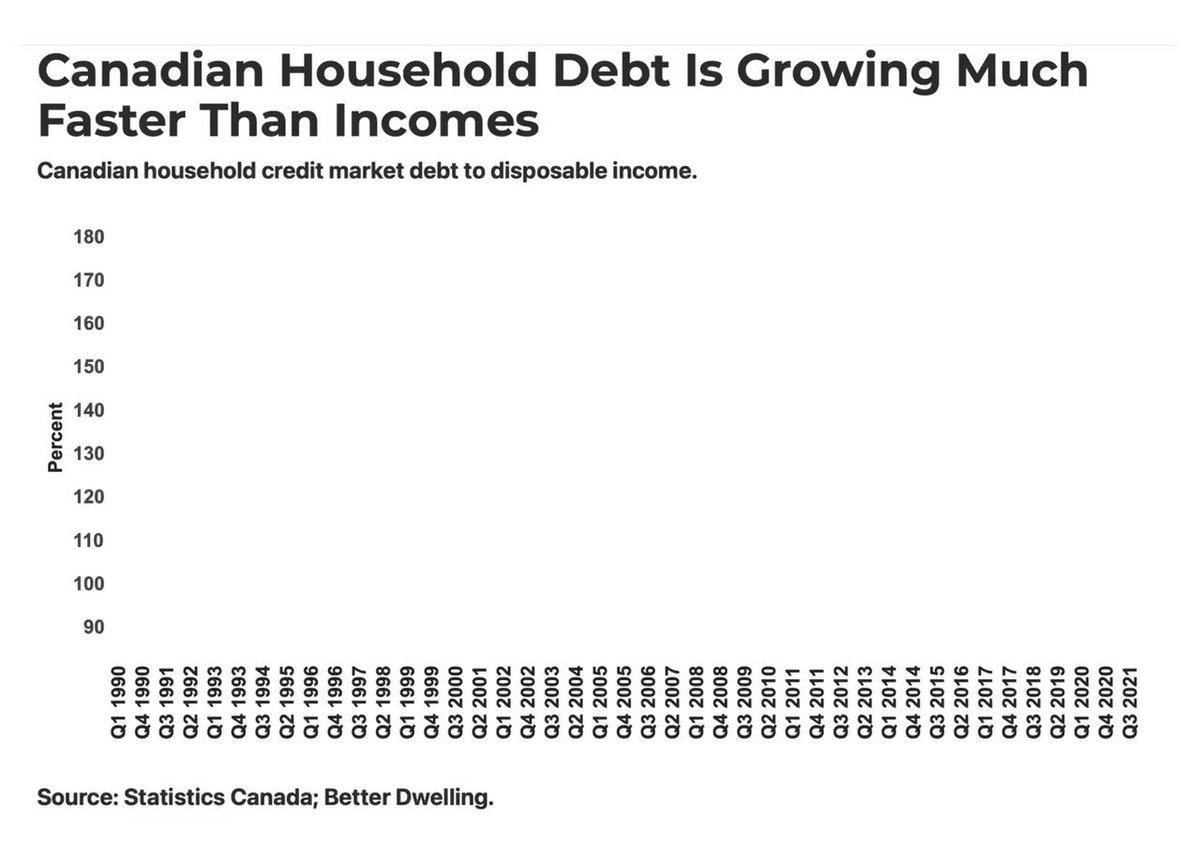

Canadian Household Debt To Income Ties Record Bigger Economic Drag This Time Better Dwelling

Margin Call

How Do Mortgage Companies Calculate Debt To Income Ratio Quora

How Do Mortgage Companies Calculate Debt To Income Ratio Quora

1

Savills Household Debt

How Do Mortgage Companies Calculate Debt To Income Ratio Quora

Pin On I Should Not Be This Weak

1

Savills Household Debt