Call option profit formula

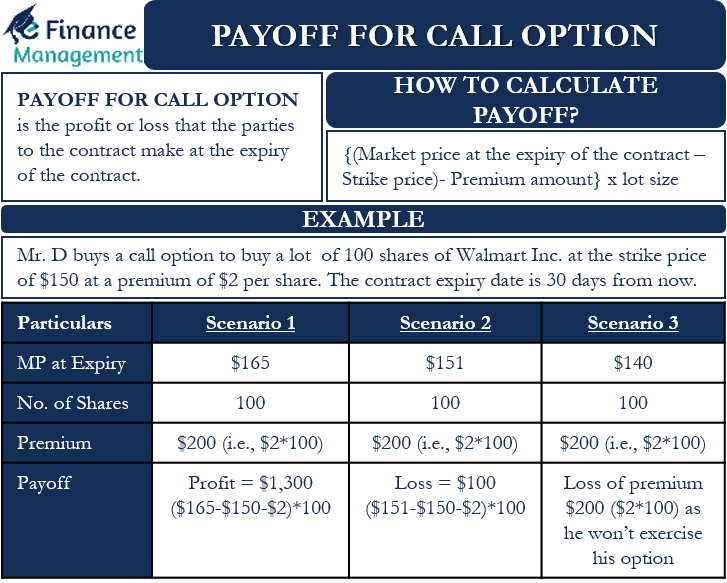

In order to explain the potential outcomes we will explore four different. The formulas for calculating payoffs and profits are as follows.

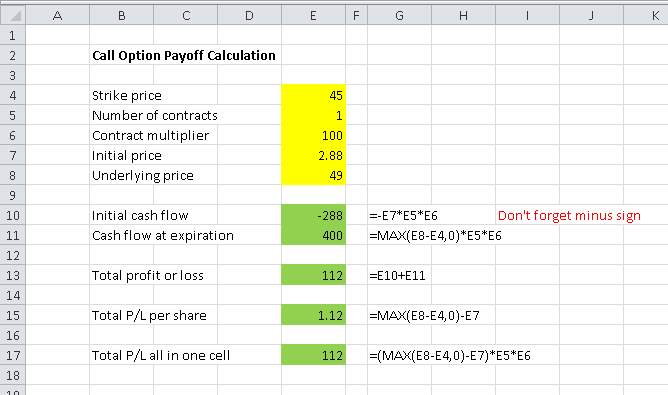

Call Option Payoff Diagram Formula And Logic Macroption

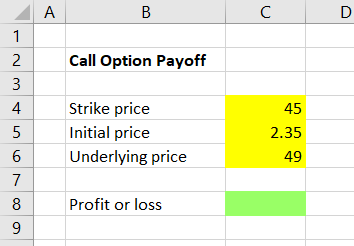

Profit Strike Price Underlying Price Initial Option Price x number of contracts Using the previous data points lets say that the underlying price at expiration is 50.

. Call buyer Payoff for a call buyer max0ST X m a x. Putting it all together call option payoff formula. If the stock price increases to 23 your profit on the sale of the stock is limited to 2 as the 22 strike price of the option limits your potential upside Your maximum profit is 220 per.

Purchasing a call is one of the most basic options trading strategies and is suitable when sentiment is strongly bullish. Your profitloss is what you sold the option for minus what you bought the option for. The Black-Scholes Formula The Black-Scholes model is perhaps the best.

In this case the stock has to rally above 1135 for the call option to pay off and below 1065 for the put. So if an investor had purchased 200 of these contracts the calculation would be. 200 8 1600.

Call PL initial cash flow cash flow at expiration. Options Profit Calculator provides a unique way to view the returns and profitloss of stock options strategies. Profit 8 x 100 x 3 contracts 2400 minus premium paid of 900 1500 1667 return 1500 900.

Breakeven BE strike price option premium 145 350 14850 assuming held to expiration The maximum gain for long calls is theoretically unlimited regardless of the. If the stock price goes down the reverse will most likely happen to the price of the calls and puts. 015 005 01 BTC.

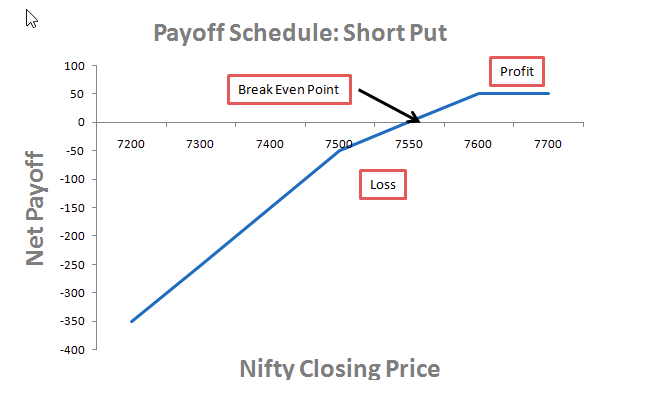

A call option costs 020 and a put option costs 015 for a total cost of 035. Profits are earned until the short call line crosses the horizontal axis which is the stock price at which the strategy breaks even. Call Option Profit or Loss Formula Because we want to calculate profit or loss not just the options value we must subtract our initial cost.

Initial CF -1 x initial option price x number of contracts x contract multiplier. This is again very simple to do we will just. Purchase of three 95 call option contracts.

As a final step subtract the total price of the premium paid for the contracts. Taking a loss breaking even and making a profit. In this example the break-even stock price is 4150 which is.

There are three outcomes when buying a call option. Payoff spot price - strike price Profit payoff premium Using the formula above your income is 1 if ABCs. Using the payoff profile and the price paid for the option the profit equation of a call option can be written as follows.

To start select an options trading strategy. Basic Long Call bullish Long. Your sell price was 015 BTC and your buy price was 005 BTC so.

It can be used as a leveraging tool as an alternative to margin.

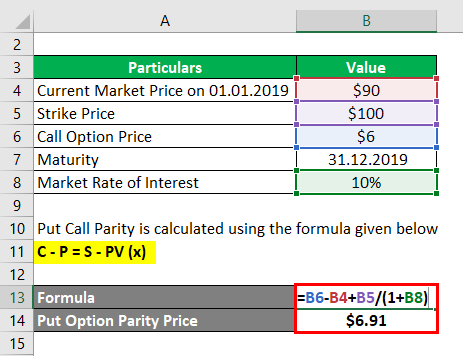

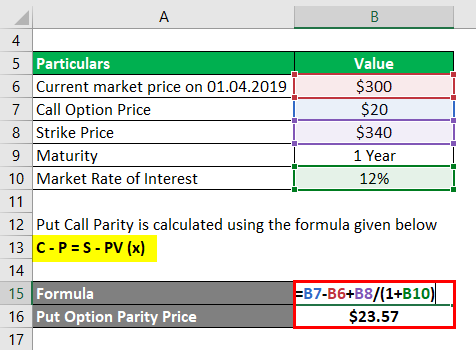

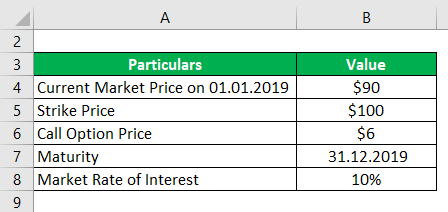

Put Call Parity Formula How To Calculate Put Call Parity

Payoff For Call Option Meaning Calculation And Examples

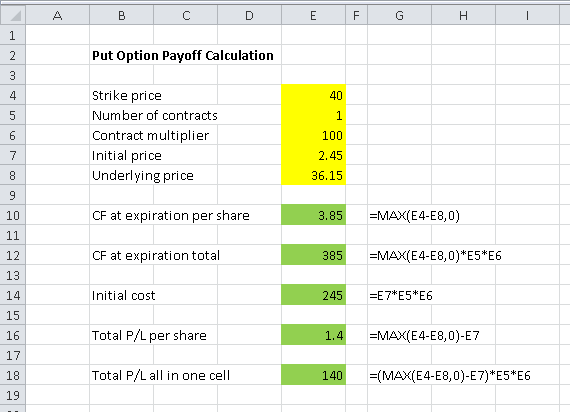

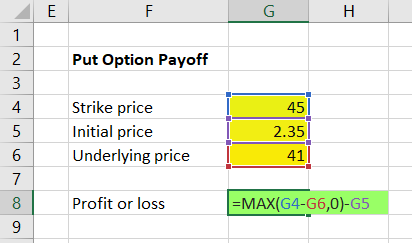

Put Option Payoff Diagram And Formula Macroption

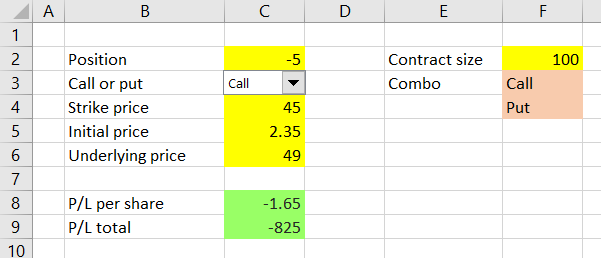

Calculating Option Strategy Payoff In Excel Macroption

Put Call Parity Formula How To Calculate Put Call Parity

Call Option Understand How Buying Selling Call Options Works

How To Calculate Payoffs To Option Positions Video Lesson Transcript Study Com

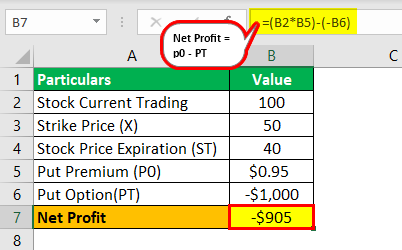

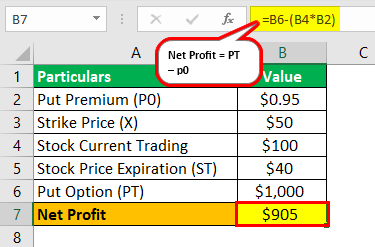

Put Options Definition Types Steps To Calculate Payoff With Examples

Put Options Definition Types Steps To Calculate Payoff With Examples

Call Option Calculator Put Option

Options Payoffs And Profits Calculations For Cfa And Frm Exams Analystprep

Put Call Parity Formula How To Calculate Put Call Parity

Calculating Call And Put Option Payoff In Excel Macroption

Put Options Definition Types Steps To Calculate Payoff With Examples

Calculating Call And Put Option Payoff In Excel Macroption

Put Call Parity Formula How To Calculate Put Call Parity

Calculating Call And Put Option Payoff In Excel Macroption